Online Commercial Property Insurance United Kingdom 2023

Getting online commercial property insurance in the United Kingdom in 2023 is not a hard task. Real estate agents or letting agents keep in touch with insurance agents. The United Kingdom is a country where insurance culture is very popular. People spend billions of pounds GBP in commercial real estate every year. Commercial real estate in the UK is expensive and people like to secure properties. The best way to secure properties is insurance. People demand insurance process be safe and secure.

The UK approved many data protection and security laws in the country. The online system is the most advanced and fast in the United Kingdom. The security of personal and business data and action against criminals attract users to use online services in the UK. Insurance is the main industry in the UK, so the government helps to protect this industry.

In the United Kingdom, the process of insurance is secure. People easily insure their properties online and offline. There is tough competition among insurance companies in the UK. In the UK governments promotes insurance culture and insurance companies. When competition is high, it is easy to find the best prices of insurance in the market.

Commercial Property Insurance Rates United Kingdom 2023

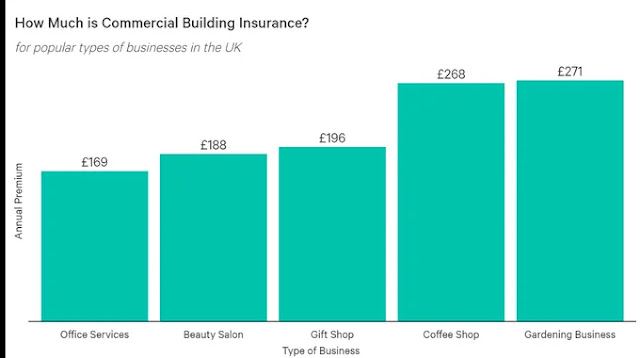

The United Kingdom is a country divided into different parts. The commercial property insurance rates are different. There are different types of commercial properties in the UK. An insurance rate depends on the property size, location, and the nature of the business. In the UK insurance companies offer different rates in different parts of the UK. Basic rates in commercial properties start from 14 GBP to 50 GBP per month. The rates vary from area to area and city to city. The Best Way to find insurance companies and rates in commercial properties, the best way to find is online search.

|

| Commercial Property Insurance United Kingdom 2023 By Trade |

The 3 Best Ways to Find Online Commercial Property Insurance UK In 2023

Find online commercial real estate insurance in the UK 2023 is in the reach of every adult. Technology is very advanced in the country. People use free and cheap internet services. Over 90% of people use smartphones, android, and apps. Online services access has everyone in the United Kingdom. People in the UK use the three best ways to find the best and lowest rates of commercial property insurance online in 2023.

Use Insurance Websites: Modern insurance business operates through websites. Every insurance company advertises its products and communicates online through its websites with customers. Commercial property owners need to go online and find insurance companies. The best method to write specific words about insurance is on Google. Get results and find the best rates and options.

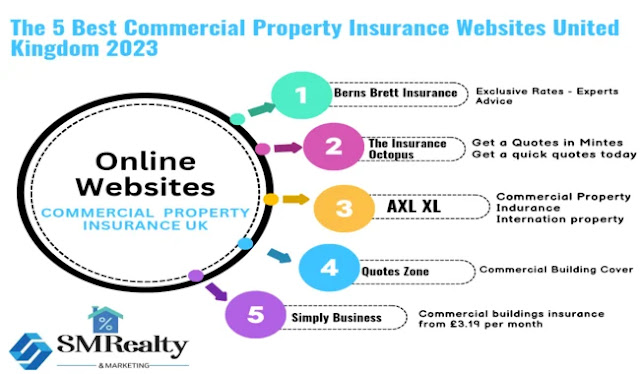

The 5 Best Online Commercial Property Insurance Websites United Kingdom 2023

There are following insurance websites offer services for commercial properties

Berns Brett Insurance (BBI) - Exclusive Rates. Expert Advice

The Insurance Octopus Get a Quote in Minutes - Get a Quick Quote Today

AXA XL - Commercial Property Insurance - International Property

Quote Zone - Commercial Building Cover - Compare UK Insurance Prices

Simply Business - Commercial Buildings Insurance from £3.19 per month

|

Online Commercial Property Insurance United Kingdom 2023 |

Remembered! In the UK bureaucracy, there is a war to get more customers. You need to check and contact different online insurance companies to get the best online commercial property rates.

Use Social Media: Social media is the most powerful medium online to find information. It is a popular medium in the modern world. Social media on different platforms have billions of users. The popularity of social media attracts business companies to make their presence online through posts, professional pages, groups, and writing large content.

Facebook, Instagram, Pinterest, twitter, medium, and LinkedIn are the best social media sources to find online insurance for commercial properties. There are thousands of insurance brokers there to offer services to customers.

There are many insurance brokers you can find online on different social media sites. You can make contact personally about commercial property insurance. Insurance brokers have personal and professional social media accounts. There is the best chance to negotiate on rates.

Blogger or Content Writers: If you find any good content about insurance online commercial properties. Make contact with authors for professional advice. Reading about the topic helps you to understand brokers and experts.

Use of Android Apps: Everyone is using Android mobile and tabs. This culture of modern technology introduces mobile application systems. Insurance companies design their business apps. Commercial real estate owners need to use or download mobile apps from different service provider companies. They can find specific information about insurance rates, terms and conditions.

Attention! Remember there are many scammers online. Make sure when you are searching brokers online on social media, Google, or download apps, they are contact numbers and the company’s representation. Once you find a broker, speak with them on calls through landline numbers. Do not fill forms with personal information i.e. name, date of birth, or home address before verification

Some steps need to be fulfilled once You Find Online Insurance

In the UK once you find online insurance for your commercial products. It is a straightforward process if you use the right approach. The above online resources are helpful for real estate clients and property owners.

Here are the steps you can follow to obtain commercial property insurance online in the United Kingdom:

1. Determine Your Insurance Needs: Determine your insurance needs and requirements. The first point you need to access your commercial properties. It includes your commercial property type, property location, the worth of your commercial product, and internal and external risks associated with your properties.

Internal commercial property assessment is essential for property owners before applying or meeting up with insurance providers. Knowledge helps to find the best insurance rates and deal with insurance brokers.

2. Research Insurance Providers: Research is an important part of finding the best insurance company. In the United Kingdom Insurance company’s market share is 15%. It is the best figure. It means people like to insure their properties. There are many big companies operating in the United Kingdom in the insurance industry.

Real estate commercial property owners are finding many insurance companies and brokers online. Many companies and brokers offer different rates online on the internet. There are many ways to find online insurance for commercial properties. Moreover, there are many groups, business pages, websites, and content writers to help you or you can get recommendations online.

3. Compare Quotes: Get insurance quotes online from different insurance companies and compare them before making a decision. Online websites of many insurance providers to obtain quotes for commercial properties. Many professional insurers offer online quote forms. If you fill it up forms and property details. They can give you an estimate after assessments.

Find online insurance brokers and discuss with them your property's details. They can also give you the best quotes. Because real estate insurance brokers have some amount of commission for selling products. Many smart brokers for their reputation of sales can cut some amount of commission. Personal contact with brokers helps you to reduce quotes.

4. Check Coverage Options: Once you find the best insurance quotes from insurance companies or brokers. The next step is to check the coverage options offered by the insurer. The best thing is to ask the insurer to mention quotes with coverage. It is easy to compare different company’s quotes and coverage’s ingredients.

Coverage options include property all kinds of damages, liability, and additional coverages and nature.

Review all aspects of coverage offered by all insurers. Policy providers must protect your property’s needs and coverage.

5. Read Policy Details: Read Policy details carefully. Policy details include terms and conditions provided by the insurer. There are many exclusions or limitations in every insurance policy. Pay close attention in the reading of the policy Once you get quotes and coverage options. Make sure you read all options policy details. Because of policy terms and conditions, policy documents apply to quotes and coverage.

Many insurer changes their policies at any time. It is important to get everything in insurance knowledge before getting a policy.

6. Consider Extras: Consider extras in insurance products. Some insurance companies add additional coverage options to increase rates. In insurance coverage, extras include business interruption insurance, flood insurance, or terrorism insurance.

Review your commercial property location, security, and geographical location. it helps you assess the current situation to consider whether you require these extras in your insurance coverage or not. If extras are unnecessary for your property then you can eliminate them. This prospect helps you to reduce your insurance rates.

7. Customer Reviews and Ratings: Many websites, apps, social media groups and pages have the option of customer reviews and ratings. Do not just judge ratings from point numbers. Read Customer reviews thoroughly.

Customer reviews and ratings a good sources to get insights and reputations of the company for customer satisfaction. However, many SEO experts during website promotion get artificial and fake reviews by paying some amount of money.

The decision to get commercial property insurance should be based on quotes, coverage items, and terms and conditions rather than customer reviews and rating insights.

8. Contact Insurers: Keep in contact with insurers in the process of insurance completion. Before dealing with insurers, Ask questions and clear are doubts in your mind regarding insurance policy.

You don’t need to be shy or hesitate to contact insurance companies if your insurance brokers not making contact with you for some reason. Online you have many options if someone is not answering phones or emails. There is a chat services option on online websites use it and get information.

9. Request Discounts: Online many players offer services. Once you check quotes and coverage packages, and read the terms and conditions. Try last time for discounts.

The beauty of English business culture is that many insurance firms compete. They do not risk dropping clients. Do not be shy to request discounts. Most insurers respect your requests.

Some insurers offer discounts for bundling multiple insurance policies, having security measures in place, or being a member of certain professional organizations. However, they hide most of the time this option, if the insured does not request discounts.

10. Finalize Your Policy: Once you find the best insurance company, compares and understand all components of insurance including quotes, and coverage ingredients according to your commercial property needs, and requirement. You have read policy documents, terms, and conditions. All details and insurance providers meet your needs. Now it’s time to purchase the policy online.

11. Payment and Documentation: Find the payment process, gather all necessary insurance documentation, a Copy of the insurance policy, and proof of coverage.

Keep all copies for your records in your documents for the future.

Make sure you pay policy payments online via bank or debit card. Keep payment receipts in your record.

12. Signature and Documentation: Complete the process of documentation and payment submission. Make your signature and insurer representative signature of hard copies. Make sure they post your original documents of insurance policy on your home address.

Author’s Conclusion to Find Online Commercial Property Insurance in the United Kingdom 2023

Online insurance companies offer commercial property insurance in the United Kingdom. In the UK insurance companies’ market share is 15%. It seems there is an insurance culture and business in the UK. People in the UK like to buy insurance policies for their real estate properties.

Online business in the UK is one of the advanced approaches to business. The advancement of technology, internet tools, and government protections regarding data security helps businesses to work online.

Online business and insurance offers to property owners are secure. Because they are data protection and cyber laws are active in the UK. The government practically imposes rules and regulations via the police act. There is a punishment and police cases for the violation of cyber-crime and data breaches. These acts give people the freedom to use services online.

To find online insurance for commercial properties online is not hard. However, it requires research to get the best insurer. Once you find the best insurer company for an insurance policy. Find and check quotes, coverage indigents, and policy terms and conditions, get some discounts, and try to complete the process of documentation, payments, and signatures.

1 Comments

is that safe to buy online insurance in united kingdom for commercial properties.

ReplyDelete